The strength of our company has allowed us to always be there for clients, governments and communities — in good times and in bad times — and this strength has enabled us to continually invest in building our business for the future.

Chairman and Chief Executive Officer, JPMorganChase

Dear Fellow Shareholders,

Across the globe, 2023 was yet another year of significant challenges, from the terrible ongoing wars and violence in the Middle East and Ukraine to mounting terrorist activity and growing geopolitical tensions, importantly with China. Almost all nations felt the effects last year of global economic uncertainty, including higher energy and food prices, inflation rates and volatile markets. While all these events and associated instability have serious ramifications on our company, colleagues, clients and countries where we do business, their consequences on the world at large — with the extreme suffering of the Ukrainian people, escalating tragedy in the Middle East and the potential restructuring of the global order — are far more important.

As these events unfold, America’s global leadership role is being challenged outside by other nations and inside by our polarized electorate. We need to find ways to put aside our differences and work in partnership with other Western nations in the name of democracy. During this time of great crises, uniting to protect our essential freedoms, including free enterprise, is paramount. We should remember that America, “conceived in liberty and dedicated to the proposition that all men are created equal,” still remains a shining beacon of hope to citizens around the world. JPMorgan Chase, a company that historically has worked across borders and boundaries, will do its part to ensure that the global economy is safe and secure.

In spite of the unsettling landscape, including last year’s regional bank turmoil, the U.S. economy continues to be resilient, with consumers still spending, and the markets currently expect a soft landing. It is important to note that the economy is being fueled by large amounts of government deficit spending and past stimulus. There is also a growing need for increased spending as we continue transitioning to a greener economy, restructuring global supply chains, boosting military expenditure and battling rising healthcare costs. This may lead to stickier inflation and higher rates than markets expect. Furthermore, there are downside risks to watch. Quantitative tightening is draining more than $900 billion in liquidity from the system annually — and we have never truly experienced the full effect of quantitative tightening on this scale. Plus the ongoing wars in Ukraine and the Middle East continue to have the potential to disrupt energy and food markets, migration, and military and economic relationships, in addition to their dreadful human cost. These significant and somewhat unprecedented forces cause us to remain cautious.

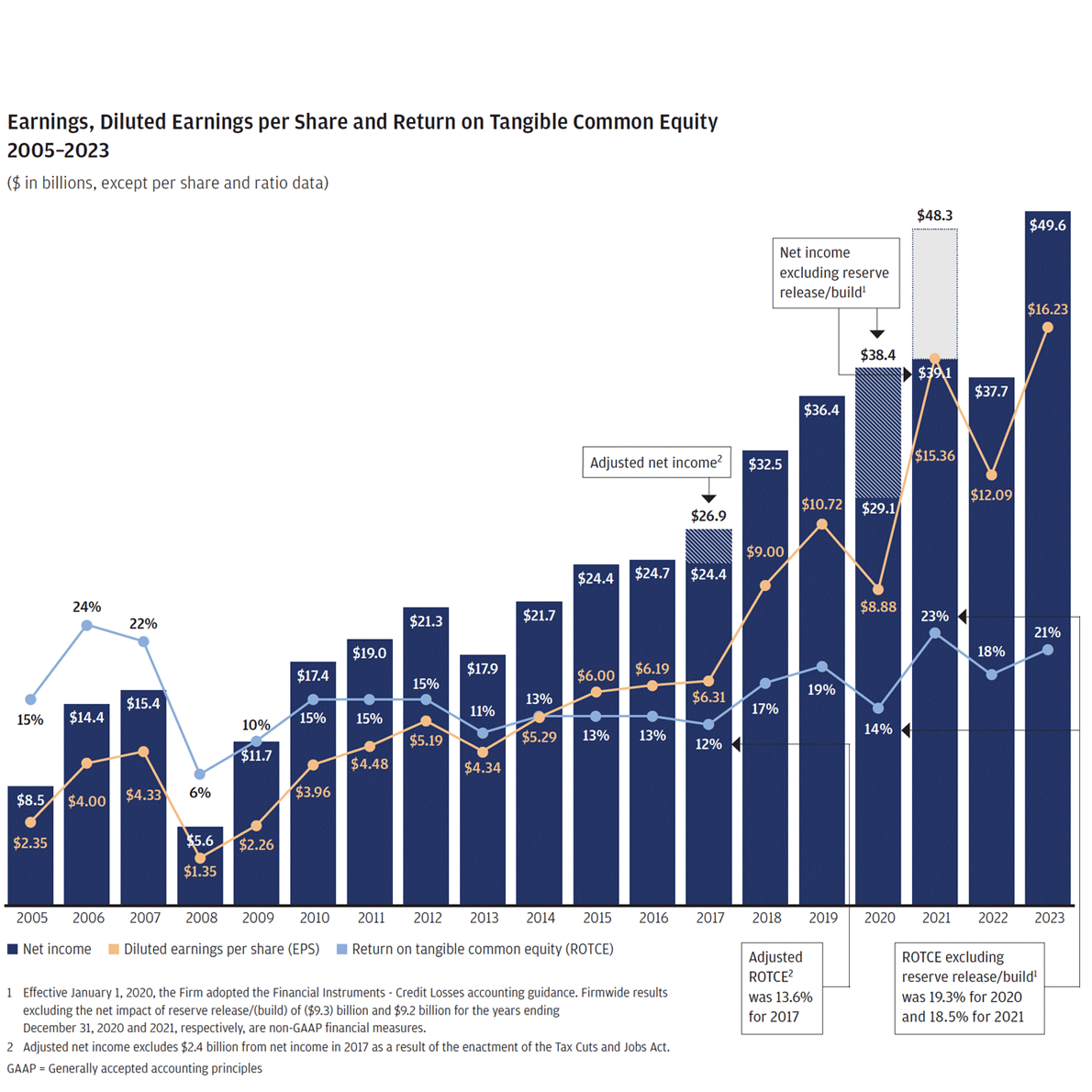

2023 was another strong year for JPMorgan Chase, with our firm generating record revenue for the sixth consecutive year, as well as setting numerous records in each of our lines of business. We earned revenue in 2023 of $162.4 billion 1 and net income of $49.6 billion, with return on tangible common equity (ROTCE) of 21%, reflecting strong underlying performance across our businesses. We also increased our quarterly common dividend of $1.00 per share to $1.05 per share in the third quarter of 2023 — and again to $1.15 per share in the first quarter of 2024 — while continuing to reinforce our fortress balance sheet. We grew market share in several of our businesses and continued to make significant investments in products, people and technology while exercising strict risk disciplines.

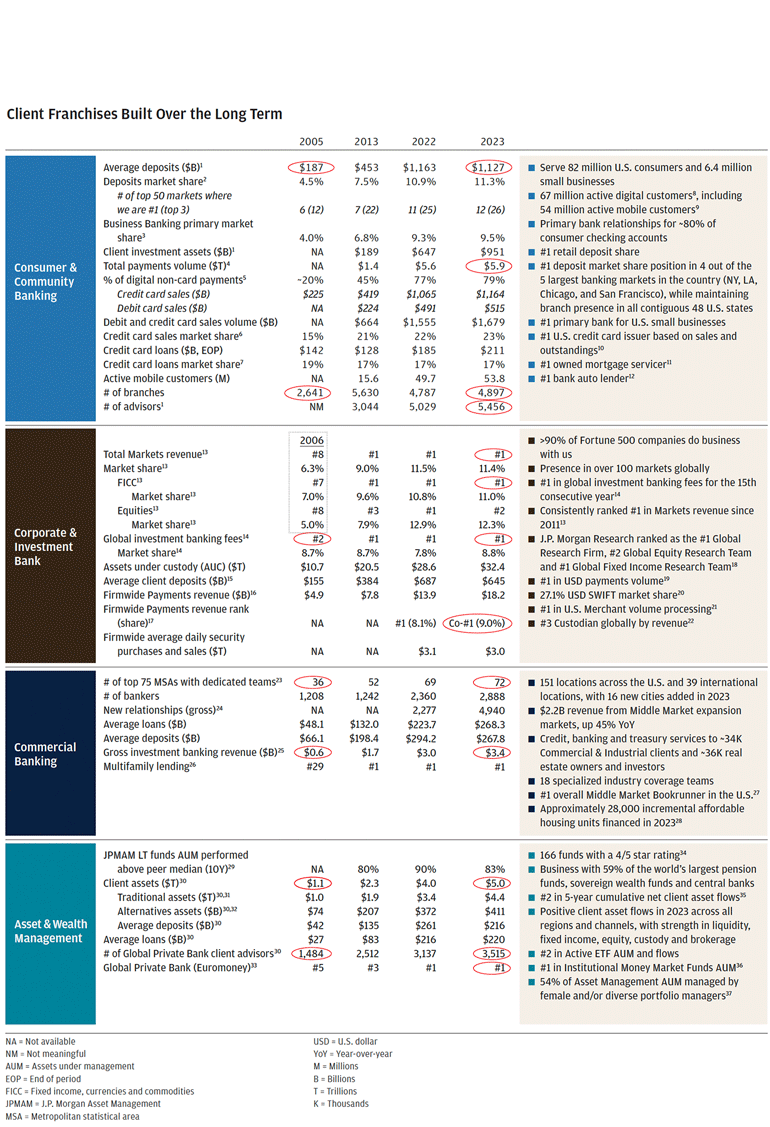

Throughout the year, we demonstrated the power of our investment philosophy and guiding principles, as well as the value of being there for clients — as we always are — in both good times and bad times. The result was continued growth broadly across the firm. We will highlight a few examples from 2023: Consumer & Community Banking (CCB) extended its #1 leadership positions and grew share year-over-year in retail deposits, credit card sales and credit card outstandings (adding close to 3.6 million net new customers to the franchise); the Corporate & Investment Bank (CIB) maintained its #1 rank in both Investment Banking and Markets and gained more than 100 basis points of Investment Banking market share; Commercial Banking (CB) added over 5,000 new relationships (excluding First Republic Bank), roughly doubling the prior year’s achievement; and Asset & Wealth Management (AWM) saw record client asset net inflows of $490 billion, over 20% higher than its prior record.

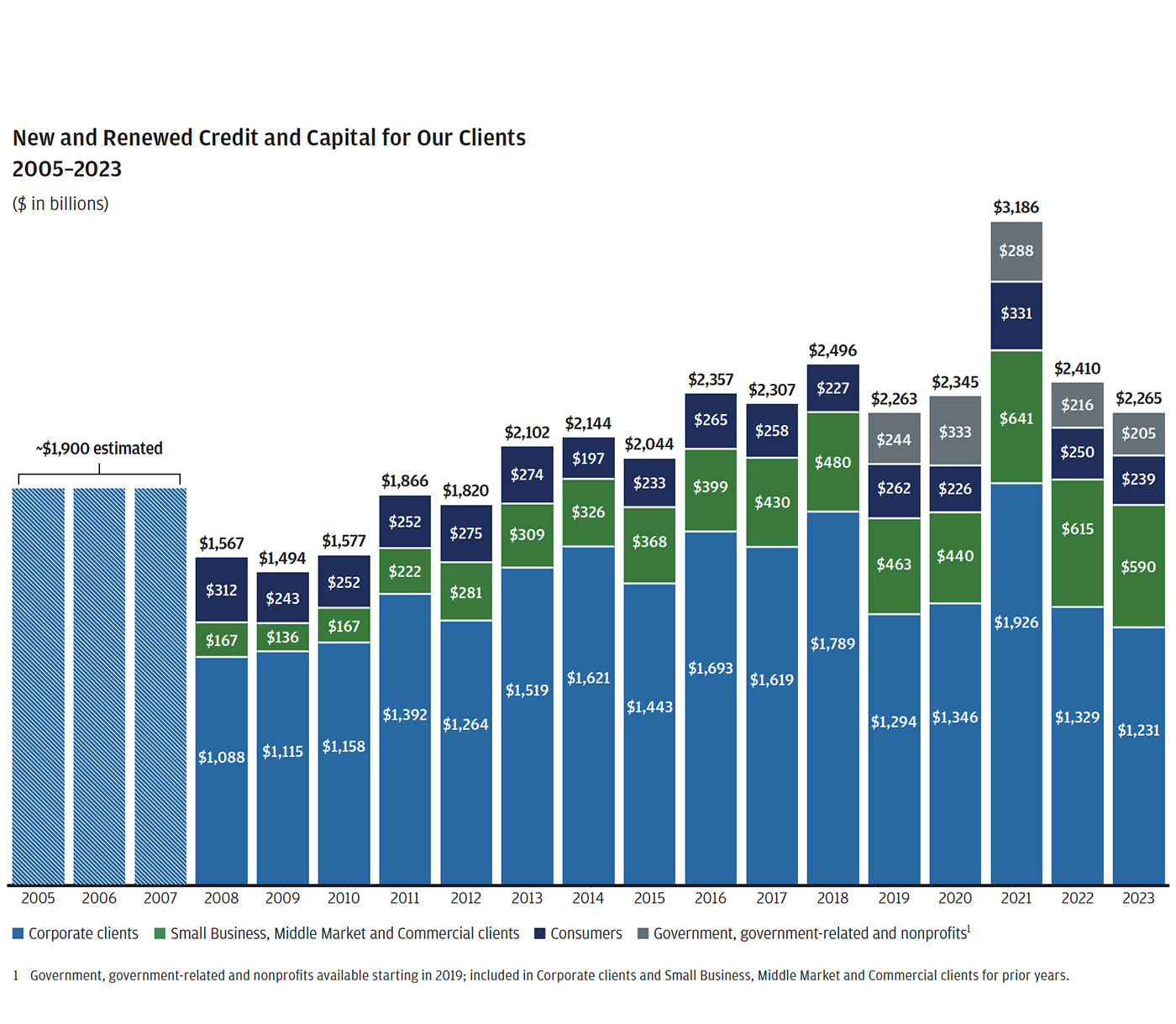

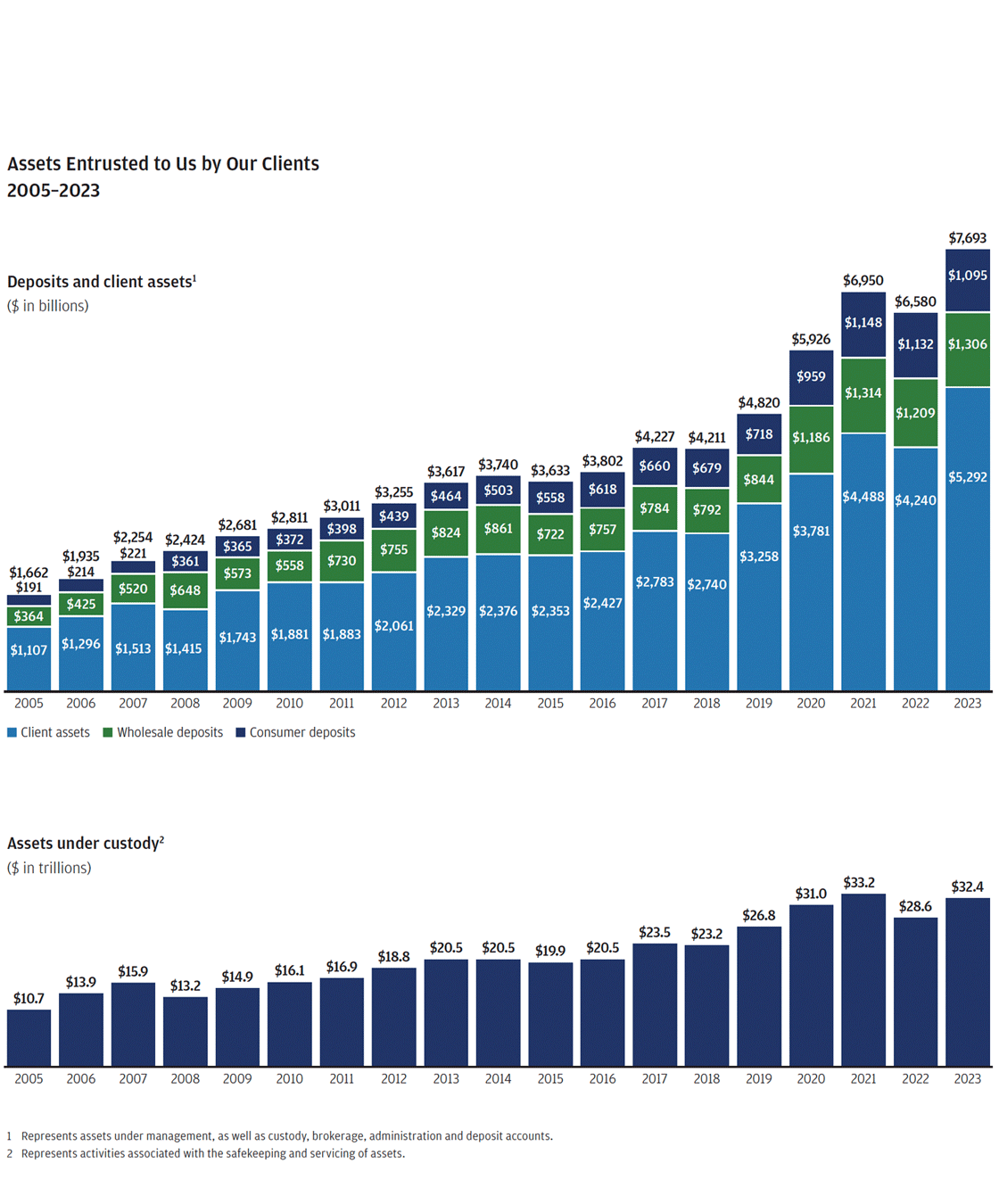

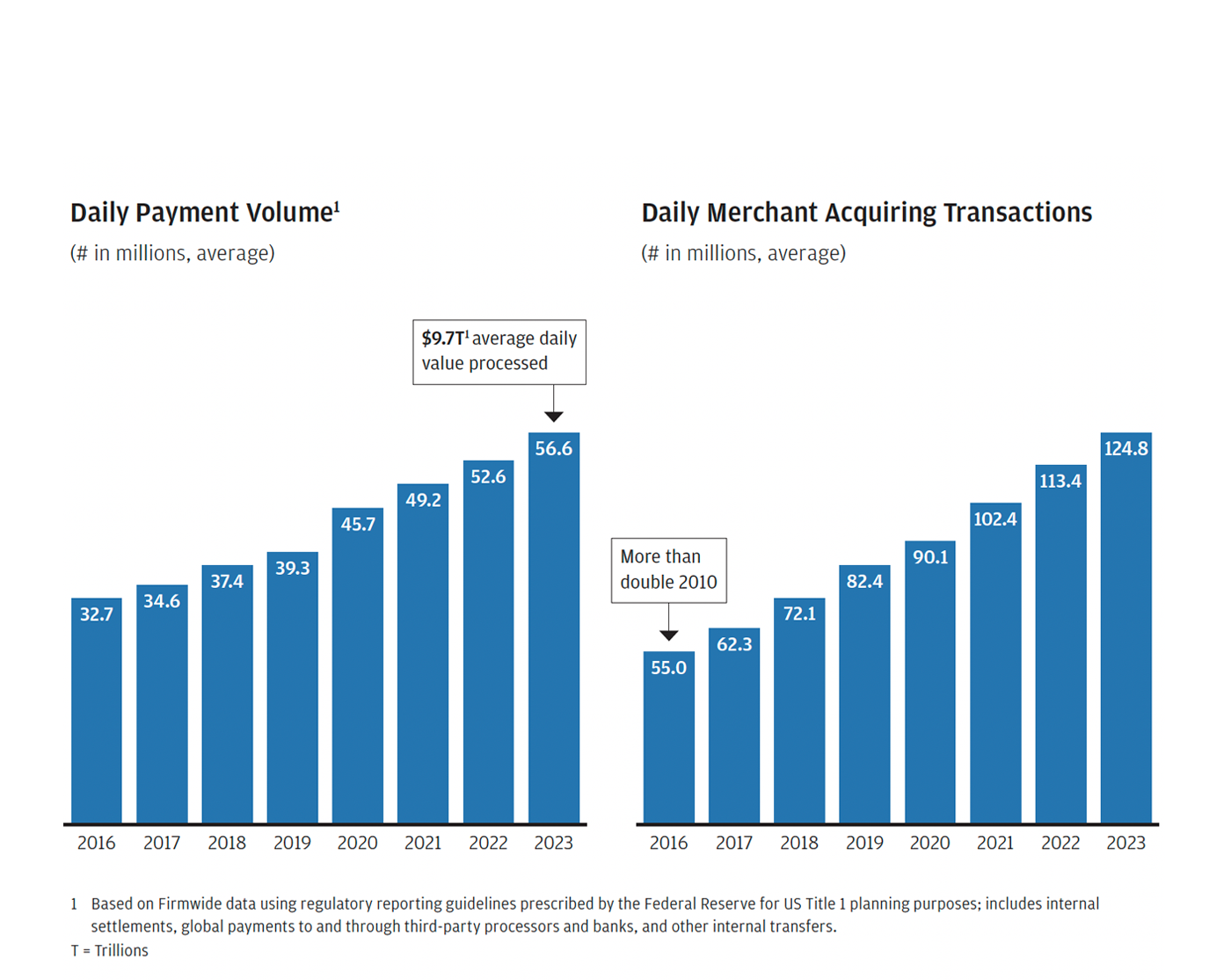

In 2023, we continued to play a forceful and essential role in advancing economic growth. In total, we extended credit and raised capital totaling $2.3 trillion for our consumer and institutional clients around the world. On a daily basis, we move nearly $10 trillion in over 120 currencies and more than 160 countries, as well as safeguard over $32 trillion in assets. By purchasing First Republic Bank, we brought much-needed stability to the U.S. banking system while allowing us to give a new, secure home to over half a million First Republic customers.

As always, we hold fast to our commitment to corporate responsibility, including helping to create a stronger, more inclusive economy — from supporting work skills training programs around the world to financing affordable housing and small businesses to making investments in cities like Detroit that show how business and government leaders can work together to solve problems.

We have achieved our decades-long consistency by adhering to our key principles and strategies (see sidebar on Steadfast Principles below), which allow us to drive good organic growth and promote proper management of our capital (including dividends and stock buybacks). The charts below show our performance results and illustrate how we have grown our franchises, how we compare with our competitors and how we look at our fortress balance sheet. Please peruse them and the CEO letters in this Annual Report, all of which provide specific details about our businesses and our plans for the future.

Looking back on the past two+ decades — starting from my time as Chairman and CEO of Bank One in 2000 — there is one common theme: our unwavering dedication to help clients, communities and countries throughout the world. It is clear that our financial discipline, constant investment in innovation and ongoing development of our people have enabled us to achieve this consistency and commitment. In addition, across the firm, we uphold certain steadfast tenets that are worth repeating.

First, our work has very real human impact. While JPMorgan Chase stock is owned by large institutions, pension plans, mutual funds and directly by single investors, in almost all cases the ultimate beneficiaries are individuals in our communities. More than 100 million people in the United States own stocks; many, in one way or another, own JPMorgan Chase stock. Frequently, these shareholders are veterans, teachers, police officers, firefighters, healthcare workers, retirees, or those saving for a home, education or retirement. Often, our employees also bank these shareholders, as well as their families and their companies. Your management team goes to work every day recognizing the enormous responsibility that we have to all of our shareholders.

Second, shareholder value can be built only if you maintain a healthy and vibrant company, which means doing a good job of taking care of your customers, employees and communities. Conversely, how can you have a healthy company if you neglect any of these stakeholders? As we have learned over the past few years, there are myriad ways an institution can demonstrate its compassion for its employees and its communities while still strengthening shareholder value.

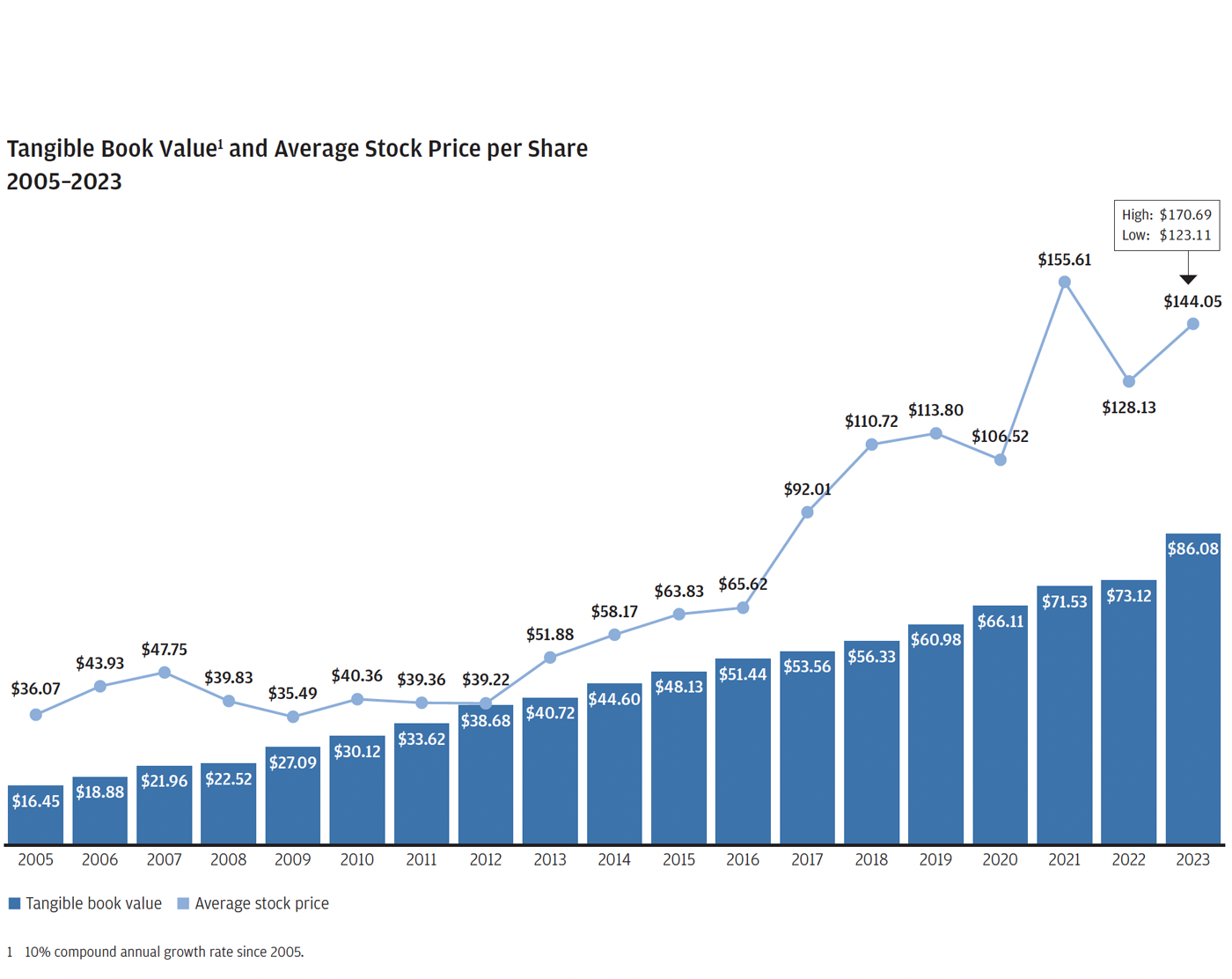

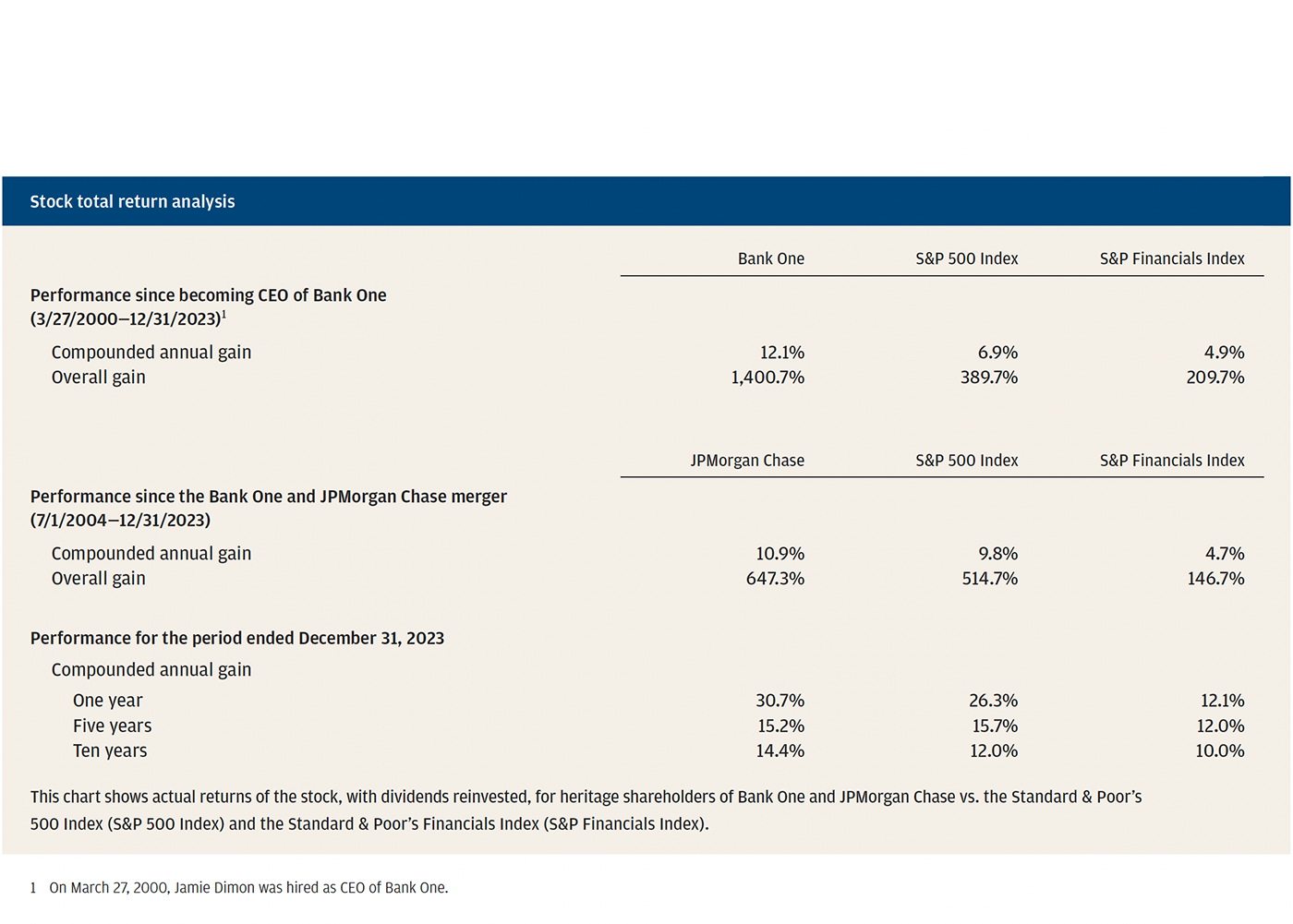

Third, while we don’t run the company worrying about the stock price in the short run, in the long run we consider our stock price a measure of our progress over time. This progress is a function of continual investments in our people, systems and products, in good and bad times, to build our capabilities. These important investments will also drive our company’s future prospects and position it to grow and prosper for decades. Measured by stock performance, our progress is exceptional. For example, whether looking back 10 years or even farther to 2004, when the JPMorgan Chase/Bank One merger took place, we have outperformed the Standard & Poor’s 500 Index and the Standard & Poor’s Financials Index.

Fourth, we are united behind basic principles and strategies (you can see the principles for How We Do Business on our website and our Purpose statement in my letter from last year) that have helped build this company and made it thrive. These allow us to maintain a fortress balance sheet, constantly invest and nurture talent, fully satisfy regulators, continually improve risk, governance and controls, and serve customers and clients while lifting up communities worldwide. This philosophy is embedded in our company culture and influences nearly every role in the firm.

Fifth, we strive to build enduring businesses, which rely on and benefit from one another, but we are not a conglomerate. This structure helps generate our superior returns. Nonetheless, despite our best efforts, the walls that protect this company are not particularly high — and we face extraordinary competition. I have written about this reality extensively in the past and cover it again in this letter. We recognize our strengths and vulnerabilities, and we play our hand as best we can.

Sixth, and this is the new one, we must be a source of strength, particularly in tough times, for our clients and the countries in which we operate. We must take seriously our role as one of the guardians of the world’s financial systems.

Seventh, we operate with a very important silent partner — the U.S. government — noting as my friend Warren Buffett points out that his company’s success is predicated upon the extraordinary conditions our country creates. He is right to say to his shareholders that when they see the American flag, they all should say thank you. We should, too. JPMorgan Chase is a healthy and thriving company, and we always want to give back and pay our fair share. We do pay our fair share — and we want it to be spent well and have the greatest impact. To give you an idea of where our taxes and fees go: In the last 10 years, we paid more than $46 billion in federal, state and local taxes in the United States and over $22 billion in taxes outside of the United States. Additionally, we paid the Federal Deposit Insurance Corporation over $10 billion so that it has the resources to cover failure in the American banking sector. Our partner — the federal government — also imposes significant regulations upon us, and it is imperative that we meet all legal and regulatory requirements imposed on our company.

Eighth and finally, we know the foundation of our success rests with our people. They are the front line, both individually and as teams, serving our customers and communities, building the technology, making the strategic decisions, managing the risks, determining our investments and driving innovation. However you view the world — its complexity, risks and opportunities — a company’s prosperity requires a great team of people with guts, brains, integrity, enormous capabilities and high standards of professional excellence to ensure its ongoing success.

I remain proud of our company’s resiliency and of what our hundreds of thousands of employees around the world have achieved, collectively and individually. Throughout these challenging past few years, we have never stopped doing all the things we should be doing to serve our clients and our communities. As you know, we are champions of banking’s essential role in a community — its potential for bringing people together, for enabling companies and individuals to attain their goals, and for being a source of strength in difficult times. I often remind our employees that the work we do matters and has impact. United by our principles and purpose, we help people and institutions finance and achieve their aspirations, lifting up individuals, homeowners, small businesses, larger corporations, schools, hospitals, cities and countries in all regions of the world. What we have accomplished in the 20 years since the Bank One and JPMorgan Chase merger is evidence of the importance of our values.

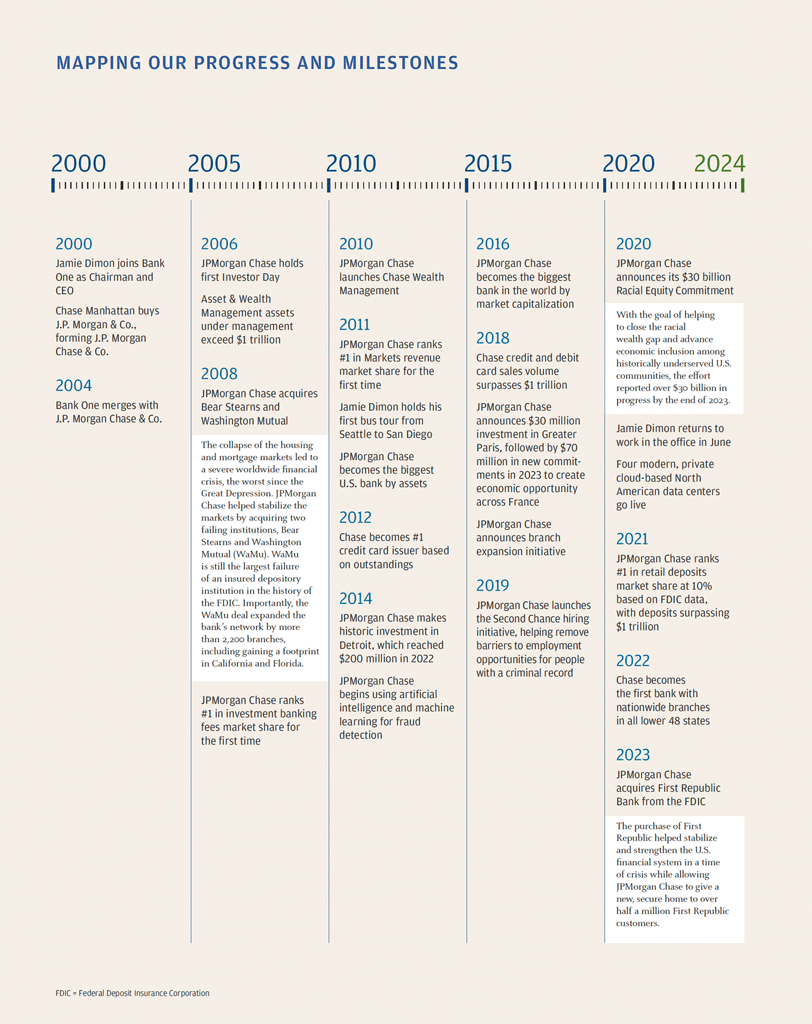

Infographic depicting Mapping our progress and milestones

By 2004, J.P. Morgan Chase already represented the consolidation of four of the 10 largest U.S. banks from 1990: The Chase Manhattan Corp., Manufacturers Hanover, Chemical Banking Corp. and, most recently, J.P. Morgan & Company. And some of their predecessor companies stretched back into the 1800s, one even into the late 1700s.

Bank One had been even busier on the acquisition front, especially across the United States. By 1998, then Banc One had more than 1,300 branches in 12 states when it announced a merger with First Chicago NBD, a Chicago-based bank created just three years earlier by the merger of First Chicago and Detroit-based NBD. Now headquartered in Chicago, the new Bank One became the largest bank in the Midwest, second largest among credit card companies and fourth largest in the United States. But the merger didn’t go as planned, with Bank One issuing three different earnings warnings. In March 2000, Bank One reached outside its executive ranks, and my tenure began as Chairman and CEO, working to overhaul the company and help bring it back to profitability and growth.

Fast forward to 2003, and another wave of consolidation was well underway in U.S. banking. Most of the nation’s larger banks were trying to position themselves to be an “endgame winner.” In the biggest deal, Bank of America agreed to buy FleetBoston Financial Corp. for more than $40 billion. Those two banks — already amalgamations of several predecessor companies — touted the breadth of their combined retail branch network.

But they were hardly alone. In 2003, some 215 deals were announced among U.S. commercial banks and bank holding companies for a total value of $66 billion, according to Thomson Financial, which tracks merger data.

In July 2004, J.P. Morgan Chase and Bank One merged — as part of a 225-year journey — to form this exceptional company of ours: JPMorgan Chase. At its merger in 2004, the combined bank was the fourth largest bank in the world by market capitalization. But with patient groundwork over the years — fixing systems and upgrading technology, managing the notable acquisitions of Bear Stearns and Washington Mutual (WaMu) and continuing to reinvest, including in our talent — we have made our company an endgame winner.

In earlier years, banks worried about their survival. While the past two decades have brought some virtually unprecedented challenges, including the great financial crisis and a pandemic followed by a global shutdown, they did not stop us from accomplishing extraordinary things. Our bank has now emerged as the #1 bank by market capitalization.

Each of our businesses is among the best in the world, with increased market share, strong financial results and an unwavering focus on serving our clients, communities and shareholders with distinction and dedication. The strengths that are embedded in JPMorgan Chase — the knowledge and cohesiveness of our people, our long-standing client relationships, our technology and product capabilities, our presence in more than 100 countries and our unquestionable fortress balance sheet — would be hard to replicate. Crucially, the strength of our company has allowed us to always be there for clients, governments and communities — in good times and in bad times — and this strength has enabled us to continually invest in building our businesses for the future.

You can see from the following charts what gains and improvements we have achieved along the way.

Infographic depicting Earnings, diluting earnings per share and return on tangible common equity 2005-2023

Infographic depicting Book value and average stock price per share 2005-2023

Infographic depicting stock total return analysis

Infographic depicting client frachises built over the long term

Infographic depicting new and renewed credit and capital for our clients 2005-2023 ($ in billions)

Infographic depicting assets entrusted to us by our clients 2005-2023

Infographic depicting Daily payment volume and daily merchant acquiring transactions

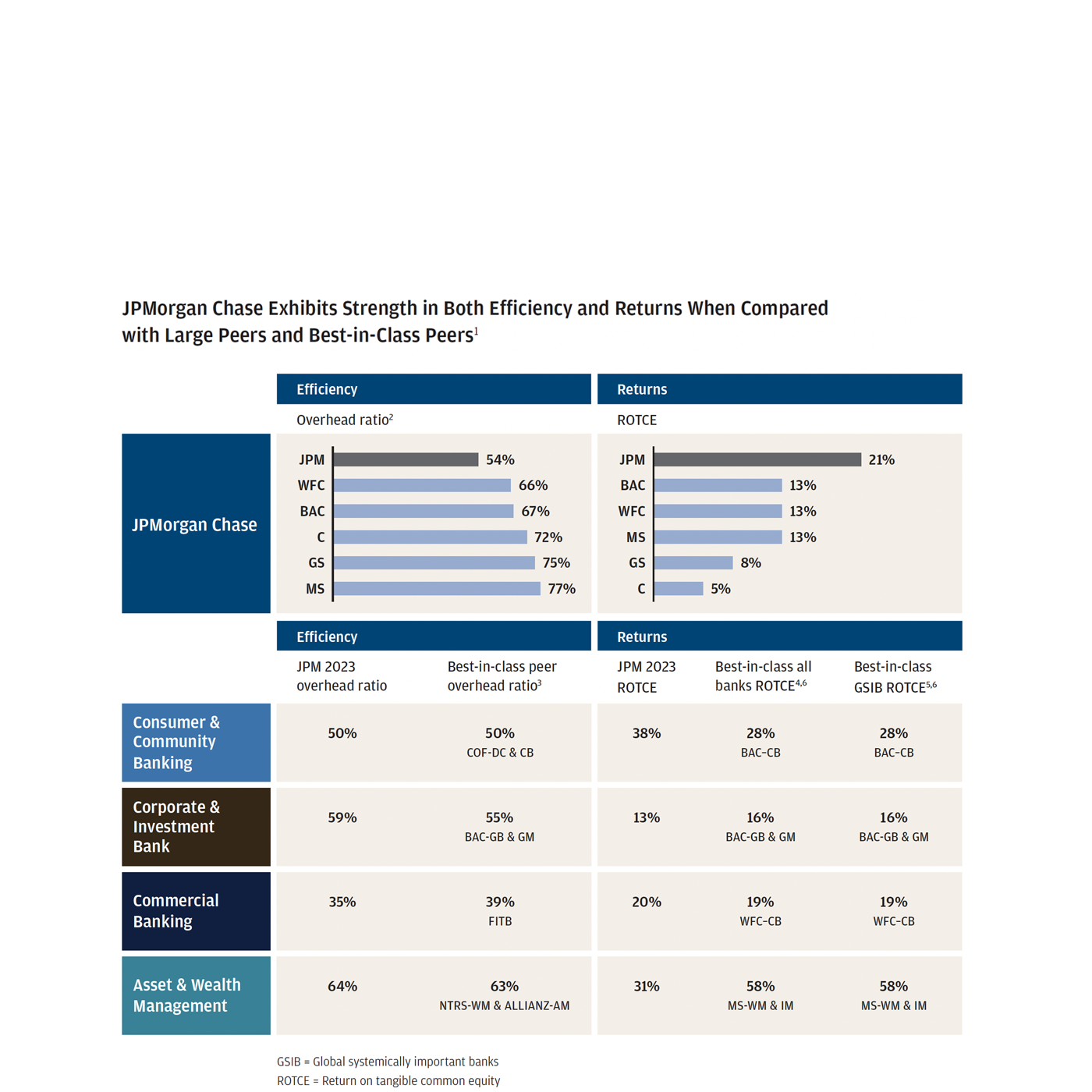

Infographic depicting JPMorgan Chase exhibits strength in both efficiency and returns when compared with large peers and best-in-class peers

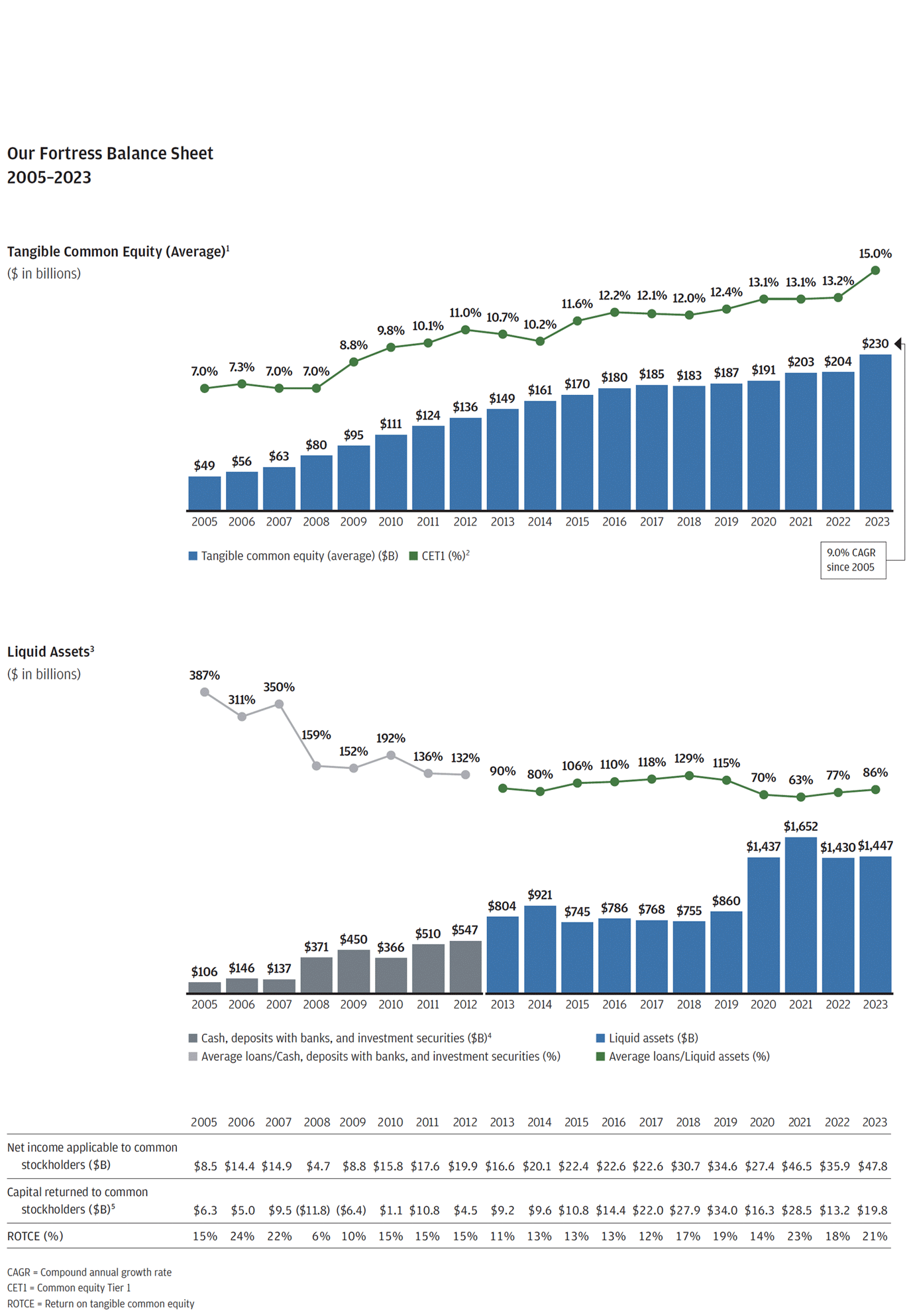

Infographic depicting our fortress balance sheet 2005-2023

Within this letter, I discuss the following:

Each year, I try to update you on some of the most important issues facing our company. First and foremost may well be the impact of artificial intelligence (AI).

While we do not know the full effect or the precise rate at which AI will change our business — or how it will affect society at large — we are completely convinced the consequences will be extraordinary and possibly as transformational as some of the major technological inventions of the past several hundred years: Think the printing press, the steam engine, electricity, computing and the Internet, among others.

Since the firm first started using AI over a decade ago, and its first mention in my 2017 letter to shareholders, we have grown our AI organization materially. It now includes more than 2,000 AI/machine learning (ML) experts and data scientists. We continue to attract some of the best and brightest in this space and have an exceptional firmwide AI/ML and Research department with deep expertise.

We have been actively using predictive AI and ML for years — and now have over 400 use cases in production in areas such as marketing, fraud and risk — and they are increasingly driving real business value across our businesses and functions. We're also exploring the potential that generative AI (GenAI) can unlock across a range of domains, most notably in software engineering, customer service and operations, as well as in general employee productivity. In the future, we envision GenAI helping us reimagine entire business workflows. We will continue to experiment with these AI and ML capabilities and implement solutions in a safe, responsible way.

While we are investing more money in our AI capabilities, many of these projects pay for themselves. Over time, we anticipate that our use of AI has the potential to augment virtually every job, as well as impact our workforce composition. It may reduce certain job categories or roles, but it may create others as well. As we have in the past, we will aggressively retrain and redeploy our talent to make sure we are taking care of our employees if they are affected by this trend.

Finally, as a global leader across businesses and regions, we have large amounts of extraordinarily rich data that, together with AI, can fuel better insights and help us improve how we manage risk and serve our customers. In addition to making sure our data is high quality and easily accessible, we need to complete the migration of our analytical data estate to the public cloud. These new data platforms offer high-performance compute power, which will unlock our ability to use our data in ways that are hard to contemplate today.

Elevating this new role to the Operating Committee level — reporting directly to Daniel Pinto and me — reflects how critical this function will be going forward and how seriously we expect AI to influence our business. This will embed data and analytics into our decision making at every level of the company. The primary focus is not just on the technical aspects of AI but also on how all management can — and should — use it. Each of our lines of business has corresponding data and analytics roles so we can share best practices, develop reusable solutions that solve multiple business problems, and continuously learn and improve as the future of AI unfolds.

We have a robust, well-established risk and control framework that helps us proactively stay in front of AI-related risks, particularly as the regulatory landscape evolves. And we will, of course, continue to work hard with our regulators, clients and subject matter experts to make sure we maintain the highest ethical standards and are transparent in how AI helps us make decisions; e.g., to counter bias among other things.

You may already be aware that there are bad actors using AI to try to infiltrate companies’ systems to steal money and intellectual property or simply to cause disruption and damage. For our part, we incorporate AI into our toolset to counter these threats and proactively detect and mitigate their efforts.

Getting our technology to the cloud — whether the public cloud or the private cloud — is essential to fully maximize all of our capabilities, including the power of our data. The cloud offers many benefits: 1) it accelerates the speed of delivery of new services; 2) it simultaneously reduces the cost of compute power and enables, when needed, an extraordinary amount of compute capability — called burst computing; 3) it provides that compute capability across all of our data; and 4) it allows us to be able to constantly and quickly adopt new technologies because updated cloud services are continually being added — more so in the public cloud, where we benefit from the innovation that all cloud providers create, than in the private cloud, where innovation is only our own.

Of course, we are learning a lot along the way. For example, we know we should carefully pick which applications and which data go to the public cloud versus the private cloud because of the expense, security and capabilities required. In addition, it is critical that we eventually use multiple clouds to avoid lock-in. And we intend to maintain our own expertise so that we’re never reliant on the expertise of others even if that requires additional money.

We invested approximately $2 billion to build four new, modern, private cloud-based, highly reliable and efficient data centers in the United States (we have 32 data centers globally). To date, about 50% of our applications run a large part of their processing in the public or private cloud. Approximately 70% of our data is now running in the public or private cloud. By the end of 2024, we aim to have 70% of applications and 75% of data moved to the public or private cloud. The new data centers are around 30% more efficient than our existing legacy data centers. Going to the public cloud can provide 30% additional efficiency if done correctly (efficiency improves when your data and applications have been modified, or “refactored,” to enable new cloud services). We have been constantly updating most of our global data centers, and by the end of this year, we can start closing some that are larger, older and less efficient.

The purchase of First Republic Bank was not something that we would have done just for ourselves. But the regulators relied on us to step forward (we worked hand in hand with the Federal Reserve, the Federal Deposit Insurance Corporation (FDIC) and the U.S. Treasury), and the purchase of First Republic helped stabilize and strengthen the U.S. financial system in a time of crisis.

The acquisition of a major company entails a lot of complexity. People tend to focus on the financial and economic outcomes, which is a reasonable thing to do. And in the case of First Republic, the numbers look rather good. We recorded an accounting gain of $3 billion on the purchase, and we told the world we expected to add more than $500 million to earnings annually, which we now believe will be closer to $2 billion. However, these results mask some of the true costs. First, approximately one-third of the incremental earning was simply deploying excess capital and liquidity, which doesn’t require purchasing a $300 billion bank — we simply could have bought $300 billion of assets. Second, as soon as the deal was announced, approximately 7,600 of our employees went from working on tasks that would benefit the future of JPMorgan Chase to working on the merger integration. Overall, the integration involves effectively combining more than 165 systems (e.g., statement, deposit, accounting and human resources) and consolidating policies, risk reporting, and other various rules and procedures. We hope to have most of the integration done by the middle of 2024.

Fortunately, we were very familiar and comfortable with all of the assets we were acquiring from First Republic. What we didn’t take on was First Republic’s excessive interest rate exposure — one of the reasons it failed — which we effectively hedged within days of the acquisition.

Our people did a great job of respectfully managing this transition, knowing that circumstances were particularly tough for our new colleagues, whom we tried to welcome with open arms. We did everything we could to redeploy individuals whose jobs were lost because of the merger (we directly hired over 5,000 people). Our approach has always been to go into an acquisition knowing we can learn things from other teams, and in this case, we did: First Republic had done an outstanding job serving high-net-worth clients and venture capitalists, and we are developing what is effectively a new business for us following First Republic’s servicing model. We will serve these high-net-worth clients through a single point of contact, supported by a concierge service model, across our distribution channels — including more than 20 new JPMorgan Chase branded branches.

In the policy section, we talk about how we may be entering one of the most treacherous geopolitical eras since World War II. And I have written in the past about high levels of debt, fiscal stimulus, ongoing deficit spending and the unknown effects of quantitative tightening (which I am more worried about than most) so I won’t repeat those views here. However, the impacts of these geopolitical and economic forces are large and somewhat unprecedented; they may not be fully understood until they have completely played out over multiple years. In any case, JPMorgan Chase must be prepared for the various potential impacts and outcomes on our company and our people.

While all companies essentially budget on a base case forecast, we are very careful not to run our business that way. Instead, we look at a range of potential outcomes for which we need to be prepared. Geopolitical and economic forces have an unpredictable timetable — they may unfold over months, or years, and are nearly impossible to put into a one-year forecast. They also have an unpredictable interplay: For example, the geopolitical situation may end up having virtually no effect on the world’s economy or it could potentially be its determinative factor.

Many key economic indicators today continue to be good and possibly improving, including inflation. But when looking ahead to tomorrow, conditions that will affect the future should be considered. For example, there seems to be a large number of persistent inflationary pressures, which may likely continue. All of the following factors appear to be inflationary: ongoing fiscal spending, remilitarization of the world, restructuring of global trade, capital needs of the new green economy, and possibly higher energy costs in the future (even though there currently is an oversupply of gas and plentiful spare capacity in oil) due to a lack of needed investment in the energy infrastructure. In the past, fiscal deficits did not seem to be closely related to inflation. In the 1970s and early 1980s, there was a general understanding that inflation was driven by “guns and butter”; i.e., fiscal deficits and the increase to the money supply, both partially driven by the Vietnam War, led to increased inflation, which went over 10%. The deficits today are even larger and occurring in boom times — not as the result of a recession — and they have been supported by quantitative easing, which was never done before the great financial crisis. Quantitative easing is a form of increasing the money supply (though it has many offsets). I remain more concerned about quantitative easing than most, and its reversal, which has never been done before at this scale.

Equity values, by most measures, are at the high end of the valuation range, and credit spreads are extremely tight. These markets seem to be pricing in at a 70% to 80% chance of a soft landing — modest growth along with declining inflation and interest rates. I believe the odds are a lot lower than that. In the meantime, there seems to be an enormous focus, too much so, on monthly inflation data and modest changes to interest rates. But the die may be cast — interest rates looking out a year or two may be predetermined by all of the factors I mentioned above. Small changes in interest rates today may have less impact on inflation in the future than many people believe.

Therefore, we are prepared for a very broad range of interest rates, from 2% to 8% or even more, with equally wide-ranging economic outcomes — from strong economic growth with moderate inflation (in this case, higher interest rates would result from higher demand for capital) to a recession with inflation; i.e., stagflation. Economically, the worst-case scenario would be stagflation, which would not only come with higher interest rates but also with higher credit losses, lower business volumes and more difficult markets. Under these many different scenarios, our company would continue to perform at least okay. Importantly, being prepared means we can continue to help our clients no matter what the future portends.

When we purchased First Republic in May 2023 following the failure of two other regional banks, Silicon Valley Bank (SVB) and Signature Bank, we thought that the current banking crisis was over. Only these three banks were offsides in having the toxic combination of extreme interest rate exposure, large unrealized losses in the held-to-maturity (HTM) portfolio and highly concentrated deposits. Most of the other regional banks did not have these problems. However, we stipulated that the crisis was over provided that interest rates didn’t go up dramatically and we didn’t experience a serious recession. If long-end rates go up over 6% and this increase is accompanied by a recession, there will be plenty of stress — not just in the banking system but with leveraged companies and others. Remember, a simple 2 percentage point increase in rates essentially reduced the value of most financial assets by 20%, and certain real estate assets, specifically office real estate, may be worth even less due to the effects of recession and higher vacancies. Also remember that credit spreads tend to widen, sometimes dramatically, in a recession.

Finally, we should also consider that rates have been extremely low for a long time — it’s hard to know how many investors and companies are truly prepared for a higher rate environment.

JPMorgan Chase does business in more than 100 countries, and we have people on the ground in over 60 countries. In almost all those locations, we do research on their economy, their markets and their companies; we bank their government institutions and their companies; and we bank multinational corporations, including the U.S. multinational corporations within their borders. This is a critical role — not only in helping those countries grow and improve but also in expanding the global economy.

Many of these countries are quite complex with different laws, customs and regulations. We are occasionally asked why we bank certain companies and even certain countries, particularly when countries have some laws and customs that are counter to many of the values held in the United States. Here’s why:

JPMorgan Chase makes an extraordinary effort as part of our “normal” day-to-day outreach to engage with individual clients, small and midsized businesses, large and multinational firms, government officials, regulators and the press in cities all around the world. This dialogue is part of the normal course of business but it is also part of building trust and putting down roots in a community.

We believe that companies, and banks in particular, must earn the trust of the communities and countries in which they operate. We believe — and we are unashamed about this — that it is our obligation to help lift up the communities and countries in which we do business. We believe that doing so enhances business and the general economic well-being of those communities and countries and also enhances long-term shareholder value. JPMorgan Chase thrives when communities thrive.

This approach is integral to what we do, in great scale, around the world — and it works. We are quite clear that whether our efforts are inspired by the goodness of our hearts (as philanthropy or venture-type investing) or good business, we try to measure the actual outcomes.

It’s also interesting to point out that many of our efforts were spawned from our work around Advancing Black Pathways, Military and Veterans Affairs, and our work in Detroit. While we’ve banked Detroit for more than 90 years, our $200 million investment in its economic recovery over the last decade demonstrated that investing in communities is a smart business strategy. We are one of the largest banks in Detroit, from consumer banking to investment banking, and it’s quite clear that not only did our efforts help Detroit, but they also helped us gain market share. The extent of Detroit’s remarkable recovery was recently highlighted when Moody’s upgraded the city’s credit rating to investment grade — an extraordinary achievement just over 10 years after the city filed the largest municipal bankruptcy in U.S. history.

For JPMorgan Chase, Detroit was an incubator for developing models that help us hone how we deploy our business resources, philanthropic capital, skilled volunteerism, and low-cost loans and equity investments, as well as how we identify top talent to drive successful business and societal improvements. I hope that, as shareholders, you are proud of our focus on promoting opportunity for all, both within and outside our organization, which includes economic opportunity. Some of our initiatives are listed below.

What began in 2020 as a five-year, $30 billion commitment is now transforming into a consistent business practice for our lines of business in support of Black, Hispanic, Latino and other underserved communities. By the end of 2023, we reported over $30 billion in progress toward our original goal. However, our focus is not on how much money is deployed — but on long-term impact and outcomes. And going forward, these programs will be embedded in our business-as-usual operating system.

We’re thoughtfully continuing our diversity, equity and inclusion efforts.

Of course, JPMorgan Chase will conform as the laws evolve. We will scour our programs, our words and our actions to make sure they comply.

That said, we think all the efforts mentioned above will remain largely unchanged. And, in fact, around the world, cities and communities where we do business applaud these efforts. We also believe our initiatives make us a more inclusive company and lead to more innovation, smarter decisions and better financial results for us and for the economy overall.

We are often asked in particular about “equity” and what that word means. To us, it means equal treatment, equal opportunity and equal access … not equal outcomes. There is nothing wrong with acknowledging and trying to bridge social and economic gaps, whether they be around wealth or health. We would like to provide a fair chance for everyone to succeed — regardless of their background. And we want to make sure everyone who works at our company feels welcome.

Before I comment about culture issues, I have a confession to make: I am a full-throated, red-blooded, patriotic, free-enterprise (properly regulated, of course) and free-market capitalist. Our company is frequently asked to take a position on an issue, rule or legislation that might be considered “cultural.” When that happens, we take a deep breath and study the matter. Many of the laws in question have many specific requirements, some of which you would agree with but not others. But we are being asked to support the entire law. In cases like these, we simply make our own statement that reflects our educated view and values; however, we do not give our voice to others.

We believe in the values of democracy, including freedom of speech and expression, and are staunchly against discrimination and hate. We have not turned away — and will not turn away — customers because of their political or religious affiliations nor would we tell customers how they should spend their money.

Our commitment to these ideals is also reflected in our employees. The talent at our firm is a vibrant mix of cultures, beliefs and backgrounds. We are, of course, fully committed to freedom of speech. There are things that you can say that would be permitted under freedom of speech but would not be allowed under our Code of Conduct. For example, we do not allow intimidation, threats or highly prejudicial behavior or speech. Our Code of Conduct clearly stipulates that certain statements and behavior, while allowed under freedom of speech, can lead to disciplinary action at our company — from being reprimanded to being fired.

In May 2023, we gathered with knowledgeable and influential people from the energy industry writ large to the government and financial services arena in Scottsdale, Arizona, for an action forum. The goal was to explore various aspects of the climate challenge and try to devise effective solutions that could help lead to meaningful progress. The climate challenge is immense and complex. Addressing it requires more than making simplistic statements and rules; rather, energy systems and global supply chains need to be transformed across virtually all industries. And there is also a deep need for new research and development. Energy systems and supply chains provide the foundation of the global economy and must be treated with care.

At the same time, the opportunity here is immense. The investment required to meet climate goals — estimated at over $5 trillion annually — could generate economywide growth and opportunity at a scale the world has not seen since the Industrial Revolution.

The task for industry, policymakers and finance is to help formulate solutions that support the transition to a low-carbon economy, balancing affordable, reliable access to energy with generating economic growth.

To find a way forward, we sought input from diverse stakeholders in pursuit of a North Star. In Scottsdale and in discussions with clients across industries about what’s needed to achieve a low-carbon economy, these five action steps and reforms were top of mind:

JPMorgan Chase recently exited Climate Action 100+ and the Equator Principles. “Why?” we are asked. While we don’t necessarily disagree with some of the principles many organizations have, we make our own business decisions. We think we have some of the best-in-class environmental, social and risk standards because we have invested in our own in-house experts and matured our own risk management processes over the years. As a result, we are going to go our own way and make our own independent decisions, gathering the best learnings of experts in the field, and, of course, we will follow all legal requirements.

First, everyone should understand that conquering the climate problem needs proper government action, particularly around taxes, permitting, grids, infrastructure building and proper coordination of policies — we are not there yet. Second, there is no known technology that can fill the gap between our “aspirations” and the current trajectory of the world. We hope and believe that this will be found (for example, through carbon capture, improved batteries, hydrogen or other measures). This new technology will also require proper government research and development funding, as the effort cannot be accomplished by private enterprise alone. And third, we are going to use the word “commitment” much more reservedly in the future, clearly differentiating between aspirations we are actively striving toward and binding commitments.

For JPMorgan Chase to play the right role in tackling the climate challenge, we have organized a special group around the green economy and related infrastructure investment. This group will coordinate and inform our work across all established industry groups (from auto to real estate, energy, agriculture and others) and includes hundreds of employees devoted to these efforts.

From Tallahassee to Miami and from Tampa to Palm Bay, JPMorgan Chase has been committed to Florida for more than 130 years and has enjoyed being the bank for all communities. Each year, we contribute billions of dollars to the economy, hire and train local residents, help to revitalize neighborhoods and remove barriers to opportunity for Floridians across the state. Our partnerships with businesses, nonprofits, government entities and community organizations have enabled us to drive sustainable impact and help them achieve their goals. We couldn’t be more proud to help make opportunity happen in Florida.

This year, we forged a relationship with Inter Miami CF, one of the most recognizable sports teams in the world. Through this partnership and the newly named Chase Stadium, we’re continuing to contribute to South Florida and its local communities. In Tampa, home to nearly 6,000 of our employees, we’re triggering an additional $210 million in economic activity and creating over 660 local construction jobs through the renovation of our Highland Oaks campus and downtown Tampa office. We’re proud that one-third of all Floridians do business with us through deposits, credit cards or a mortgage. Through each of our investments across the state, we’re ensuring that residents have the resources and tools they need to thrive.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank) was finished 14 years ago, and we believe it accomplished a lot of good things. But it’s been quite a while since then, and we’re still debating some very basic issues. It’s time to take a serious, hard, honest look at what has been done and what can be improved.

It’s good to remember that the United States has the best financial system in the world, with diversified, deep and experienced institutions, from banks, pension plans, hedge funds and private equity to individual investors. It has healthy public and private markets, transparency, rule of law and deep research. The best banking system in the world is a critical part of this, and, integrated with the overall financial system, is foundational to the proper allocation of capital, innovation and the fueling of America’s growth engine.

This is not about JPMorgan Chase — we believe we can manage through whatever is thrown our way. This is about the impact on all parts of the system — from smaller banks to larger regional banks that may not have the resources to handle all of these regulatory requirements. It’s also about the effect on the financial markets and the economy from the rapidly growing shadow banking system, as well as the ultimate impact on the customers, clients and communities we serve. This is about what’s right for the system.

The banking system is not static: There are startup banks, mergers, successful upstarts and fintech banks, and even Apple, which effectively acts as a bank — it holds money, moves money, lends money and so on. Nonbanks are competing with traditional banks, and, in general, this dynamism and churn are good for innovation and invention — with success and failure simply part of the robust process. Innovation runs across payments systems, budgeting, digital access, product extensions, risk and fraud prevention, and other services. Different institutions play different roles, and, importantly, small banks and big banks serve completely different strategic functions. Large banks bank multinational corporations around the world, make healthy markets, and wield technology and a product set that are the best in the world. A small bank simply cannot bank these same multinational governments and safely move the amount of money and securities that large banks do. Regional and community banks have exceptional local knowledge and presence and are critical in serving thousands of towns and certain geographies.

It is also important to recognize that the banking system as we know it is shrinking relative to private markets and fintech, which are growing and becoming increasingly competitive. And remember that many of these new players do not have the same transparency or need to abide by the extensive rules and regulations as traditional banks, even if they offer similar products — this often gives them significant advantage.

To deal with this fluid environment, banks of all sizes develop their own strategies, whether to specialize, expand geographically or embark on mergers and acquisitions. There are certain banking services where economies of scale are a competitive advantage, but not all banks need to become bigger to gain this benefit (there are many highly successful banks that are smaller). What is clear is that banks should be allowed to pursue their individual strategies, including mergers and acquisitions, as they see fit. Overall, this process should be allowed to happen — it’s part of the natural and healthy course of capitalism — and it can be done without harming the American taxpayer or economy.

While we all want a strong banking and financial system, we should step back and assess how all the regulatory steps we have taken measure up against the goals we all share. Since Dodd-Frank was signed into law in 2010, thousands of rules and reporting requirements written by 10+ different regulatory bodies in the United States alone have been added. And it would probably be an understatement to say that some are duplicative, inconsistent, procyclical, contradictory, extremely costly, and unnecessarily painful for both banks and regulators. Many of the rules have unintended consequences that are not desirable and have negative impacts, such as increasing the cost of credit for consumers (hurting lower-income Americans the most).

Both regulators and banks should want the same thing — a healthy banking system, serving its clients and striving for continuous improvement. We all should also want the enormous benefits that would come from good collaboration between regulators and bank management teams and boards.

Over time, these relationships have deteriorated, and, again, are increasingly less constructive. There is little real collaboration between practitioners — the banks — and regulators, who generally have not been practitioners in business. While we acknowledge the dedication of regulators who work with banks on a daily basis, management teams across the industry are putting in a disproportionate amount of time addressing requests for extra details, documentation and processes that extend far beyond the actual rules — and distract both regulators and management from more critical work. We should be more focused on the truly important risks for the safety of the system. And unfortunately, without collaboration and sufficient analysis, it is hard to be confident that regulation will accomplish desired outcomes without undesirable consequences. Instead of constantly improving the system, we may be making it worse. A few additional points:

Unfortunately, some recent regulations are ending up in court. You can imagine that no one wants to sue their regulators. Banks would not sue if they did not think they were right — or if they thought they had any other recourse — which they effectively do not. This is definitely not what anyone should want. A more constructive relationship with regulators would reduce confusion and uncertainty and would lead to better outcomes for banks, their shareholders, and their clients, customers and communities.

True collaboration could dramatically improve the banking system. For example:

We can fix the housing and mortgage markets. For example, mortgage regulations around origination, servicing and securitization could be simplified, without increasing risk, in a way that would reduce the average mortgage by 70 or 80 basis points. The Urban Institute estimates that a reduction like this would increase mortgage originations by 1 million per year and help lower-income households, in particular, buy their first home, thereby starting them on the best way to build household net worth.

I know this might be wishful thinking, but now would be a good time to step back and have a thorough and candid review of the thousands of new rules passed since Dodd-Frank. After this review, we should ask what is it that we really want: Do we want to try to eliminate the possibility of bank runs? Do we want to change and create liquidity rules that would essentially back most uninsured deposits? Do we want the mortgage business and leveraged lending business to be inside or outside the banking system? Do we want products that are inside and outside the banking system to be regulated the same way? Do we want to reasonably give smaller banks a leg up in purchasing a failing bank? And while Dodd-Frank did some good things, shouldn’t we take a look at the huge overlapping jurisdictions of various regulators? This overlap creates difficulties, not only for banks, but for the regulators, too. Any and all of this is achievable, and, I believe, could be accomplished with simpler rules and guidelines and without stifling our critical banking system.

Before we discuss market making and financial markets, readers should understand that market making occurs in almost all businesses. There are healthy markets in farm animals, foreign products, commodities, energy, logistics, healthcare and so on. Healthy markets increase customer choice and reduce cost. They almost always involve holding inventory and taking some risk, which is simply a part of the process. America’s financial markets are the biggest in the world — U.S. public debt and equity markets total $137 trillion, constituting the biggest “market” in the world, and are larger than America’s gross domestic product (GDP) of $27 trillion.

Market participants are not “Wall Street.” They are large and small, mainly sophisticated, global investors (pension plans, mutual funds, governments and individuals) representing retirees, veterans, individuals, unions, federal workers and others. They all benefit from our efficient, low-cost and transparent markets.

Some regulators seem to think that market making is a speculative, hedge fund-like activity — and this thinking is what might be leading them to constantly increase capital requirements. The proposed capital rules could fundamentally alter market-making activities that are critical to a thriving economy, particularly in difficult markets when market making is even more important. The new rules would raise capital requirements by 50% for major banks — which could undermine market stability, make banking services costlier and less accessible, and push even more activity to a less regulated banking system.

We should recognize that the United States has the biggest, deepest and most liquid capital markets in the world. For these markets to function, it is critical for transparency and liquidity to be in the secondary market. Market making provides this, promoting the flow of capital to real economy investments and supporting all sectors of the economy, including companies, state and local governments, universities, hospitals, pension plans and overall job creation. Without market making in the secondary market, it would be extremely difficult for companies to raise capital through the primary market — equity and debt offerings — which have totaled approximately $3.6 trillion on average over the past few years. The incredible strength of these markets enables companies of all sizes to grow and expand especially during times of volatility and stress. It also enables consumers to access cheaper credit and governments (local, state and federal) to reduce their borrowing costs.

JPMorgan Chase spends $700 million per year in extensive research coverage of nearly 5,200 companies across 83 countries. This massive effort continuously educates investors and decision makers around the world and often leads to improved governance and management. It also critically complements the firm’s market-making activities and further promotes transparency, enabling investors to make thoughtful choices around investing in capital markets.

I would also like our shareholders to know that our market making is backed by approximately $7 billion in support expenses, including over $2 billion in technology spend alone each year. This investment allows us to maintain global trading systems and constantly improve upon risk management and efficiency.

JPMorgan Chase deploys approximately $70 billion in capital to maintain our Markets franchise. This capital supports $500 billion in securities inventory (largely hedged) — and this inventory allows us to buy and sell $2 trillion (notional) in securities daily for our clients.

The main objective of market makers is to continuously quote prices and diligently manage an inventory to transact at those prices, which includes assuming certain risks to support heavy volumes and orderly trading. Market makers have a moral obligation to try to make markets in good times and in bad. Part of our brand promise is to stand ready as the willing buyer and seller. In this, we have never failed. In addition, in most cases regarding government debt, where we serve as a government securities dealer, we are legally obligated to make markets. This constant visibility into prices provided by market makers fosters investor confidence, keeps fees low and promotes economic growth by attracting more investors.

Many large market participants — for example, hedge funds and high-frequency traders, among others — have no obligation to make markets. In fact, many of these market participants often “step out” of the markets and dramatically reduce liquidity specifically when market conditions are difficult.

Market making is not particularly speculative since market makers generally hedge their positions, as you will see from some real life examples of the economics and risks. We earn revenue of approximately $100 million on a typical day. In the average year, the total is nearly $30 billion. On our $2 trillion in notional daily trading, this amounts to only one hundredth of a cent charged to the investor for these services — an extraordinarily low cost compared with any other market in the world.

Now let’s take a look at the actual risk and results versus the hypothetical risk and results. The hypothetical global market shock of the CCAR stress test has us losing $18 billion in a single day and never recovering any of it. Let’s compare that to actual losses under real, actual market stress.

Now consider these historical data points: First, over the last 10 years, the firm’s market-making business has never had a quarterly loss and has lost money on only 30 trading days. These loss days represent only 1% of total trading days, and the average loss on those days was $90 million. Second, when markets completely collapsed during the COVID-19 pandemic (from March 2 through March 31, 2020, the stock market fell 16%, and bond spreads gapped out dramatically), J.P. Morgan’s market-making activities made money every day prior to the Federal Reserve’s major interventions, which stabilized the markets. During that entire month, we lost money on only two days but made $2.5 billion in Markets revenue for the month. And third, in the worst quarter ever in the markets following the 2008 failure of Lehman Brothers, we lost $1.7 billion, but we made $5.6 billion in Markets revenue for the full year. The firm as a whole did not lose money in any quarter that year. In 2009, there was a complete recovery in Markets, and we made $22 billion in Markets revenue.

You can see that our actual performance under extreme stress isn’t even close to the hypothetical losses of the stress test.

Another major fallacy is that derivatives are objects of financial destruction. In reality, derivatives are an essential part of managing financial risk and are used by investors, corporations, farmers, businesses, countries, governments and others to manage their risks. And more than 85% of derivatives are fairly basic forms of foreign exchange or interest rate swaps.

One last fallacy is that the repo markets are all about speculation. While it’s true that repo is used by certain investors to leverage up their positions, about 75% of repo is essential to normal money market functioning, i.e., is done by broker-dealers financing their actual inventory positions, money market funds investing their cash backed by highly rated collateral and clients hedging their positions.

In addition, more liquidity, not less liquidity, will be needed to maintain market stability. Large banks keep an inventory of securities they can deploy in times of stress to help soothe markets; however, with the implementation of new regulations, banks now hold 70% as much inventory in securities as they did before the 2008 financial crisis, while the total size of the market has almost tripled. Higher capital requirements will accelerate this trend even further, impacting banks’ ability to deliver support to clients and markets in times when it is needed the most.

If this proposal is enacted as drafted:

More market activity will move to unregulated institutions, out of sight from regulators and without the same level of consumer protections that Americans expect from their banks. Other market participants that don’t have holistic client relationships are less likely to provide liquidity to help stabilize markets.

In volatile times, banks have been able to intermediate to help their clients and to work with the regulators. With new regulations, they may be less able to do so. There have been several times in the past few years where banks had ample liquidity and capital but were unable to rapidly increase their intermediation in the markets due to very rigid liquidity and capital requirements. Finally, the proposed rules increase the chance that the Federal Reserve will have to step in again — and this is not something they should want to do on a regular basis but only in an extreme emergency.