Many business owners told us that GST in Singapore is an administrative headache. It's complicated, time-consuming, and nerve-wracking. One small mistake could cost businesses thousands of dollars.

Some business owners are also uncertain about when and which Singapore GST applies to their business. Don't worry, as we'll explain how this whole tax system works.

We'll cover the following in this article.

GST is a consumption tax added to the price of goods and services in Singapore. It means that when you buy something, the business adds it to your bill.

The business collects the tax from every sale then pays it to IRAS every month/ quarter. An announcement to increase the GST rate was made within the release of the Singapore Budget 2022. The increase in GST rate started in 2023, with the GST rate going from 7% to 8%.

As of 1 January 2024, the Singapore GST rate is 9%.

At this point, you may be wondering:

The answer is NO.

Don't worry; we will explain everything in detail below.

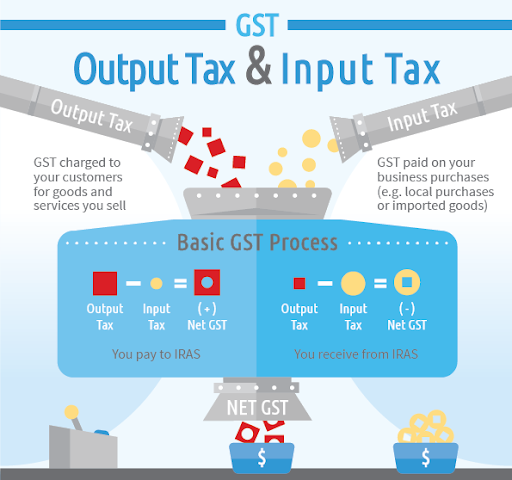

The following infographic provides a good summary of how the GST system works in Singapore.

As you can see, the system works in two ways for GST-registered businesses in Singapore:

You read that right. Business owners will also need to pay GST. If you haven't noticed, this GST is charged to you via raw materials, services, or other items required by your company to work. Whatever products/items you purchased or services you hired for your business will charge you GST the same way you're charging GST to your customers.

Here's the best part, though - You can claim the GST back as a business expense if you are GST registered company in Singapore!

When filing for GST, a business will pay IRAS the net GST.

This is done by deducting Input Tax (GST paid for business purchases or services hired for the business) from Output Tax (GST your business charged and collected from customers).

If you paid more for GST than GST collected from customers, then IRAS will pay you the difference.

For example, your company collects S$1,000 of GST from customer purchases over the last three months and the GST you paid for purchases or services for the business is S$1,200, then it will look like this:

(Output tax) S$1,200 - (Input tax) S$1,000 = S$200.

IRAS will pay you S$200. If it's the other way around, like if your Input Tax is higher than Output Tax, then you'll need to pay the difference to IRAS.

I guess many business owners want to know whether GST applies to them first before learning about its ins and outs.

The short answer to you is:

Let's look into more detail above compulsory and voluntary GST registrations in Singapore.

According to IRAS, two ways exist to define the taxable turnover for Singapore GST registration.

For companies that expect to hit more than S$1 million in taxable turnover in the next 12 months, the following documents are required:

So, when do you have to register the GST if you meet any of the criteria described above?

In summary, GST registration should be done within 30 days from

Check out the tables below for better illustrations.

Can business owners volunteer to register for GST if their annual turnover does not exceed S$1 million?

The answer is YES, as long as they meet the following requirements set forth by IRAS. You can check out the conditions here.

We will come back to address the benefits and drawbacks of voluntary GST registration in the sections below.

Yes, businesses may be exempted from GST registration even if their annual taxable turnover is more than S$1 million.

The exemption is granted if your business meets both conditions:

Once a business owner is approved for exemption, they are exempted from

The downside of being granted an exemption is that you cannot claim the Goods and Services Tax spent on company purchases.

The Singapore GST registration procedure is effortless and straightforward.

You can submit the application form via

According to IRAS, it will take about ten working days to process your application. This is also assuming that you send the correct documents too.

Once the business is registered for GST, it must remain registered for two years. You may also hire a corporate service provider, like Piloto Asia, to assist you with GST registration in Singapore.

The processing time will be longer if you voluntarily register GST. It may take up to three working weeks for voluntary registrations. This is because IRAS will ask you to sign up for GIRO, where you'll be making GST payments and refunds. GIRO application takes time to process, depending on your bank and how long it takes them to approve it.

Overseas vendors will need to register for GST with the Inland Revenue Authority of Singapore (IRAS) under The Overseas Vendor Registration (OVR) Regime.

Starting 1 Jan 2023, GST is extended to low-value goods (LVG) imported into Singapore via post or air through the OVR Regime. This change allows local businesses to compete evenly against overseas vendors. The change is also implemented to ensure that the GST system continues to be resilient and fair as digital economy grows.

What’s The Definition of Low-Value Goods?

LVG Goods are defined as goods which at the point of sale:

Charging GST for Overseas Suppliers

OVR vendors are required to collect GST at the point of sale on supplies of low-value goods to:

OVR Vendors are also required to pass down the following information down to their logistics chain so that relevant GST information is available for import permit application:

Import GST relief is granted on goods imported by air, but goods such as alcohol and other intoxicating liquors and tobacco are excluded. This import relief is based on the total value of goods based on CIF (Cost, Insurance, and Freight) not exceeding S$400. ‘

As of 1 Jan 2023, there are no changes to the permit requirements and import procedure for goods imported after the said date so as long as the total CIF value of the consigned goods does not exceed S$400. However, importing of controlled goods such as liquors and tobacco requires the necessary important permits from their respective Competent Authorities (CA).

Do you have questions about how GST works in Singapore?

Fill up our form below to talk to one of our dedicated account managers.

We will get back to you in as little as 1 business day.

Once you are successfully registered for GST, IRAS will send you a letter of notification.

Please take note of the effective date of the GST registration, as this will be the date when you start charging and collecting GST.

You'll also need to do the following:

To support the GST declaration and claim the taxes, keep your business records and invoices dating back at least five years. If you lose some of them, you may be unable to claim the taxes back.

The current GST rate is 7%. But not all goods and services are charged this standard rate.

Before we discuss the types of goods and services that are subject to GST, we'll need to talk about the two GST rates that business owners should be aware of:

So, Singapore's GST rate can be either 9% or 0%.

Next, you need to know under what instances the GST is applied.

See the summary below for your reference:

GST is only applied when the "place of supply" or the business is in Singapore. Supply refers to the activity of providing goods to further the business of a taxable person.

This means that the physical transfer of ownership of goods is done in Singapore.

For example, a gas station providing petrol to customers is considered a "supply of goods" because the station receives money in exchange for the petrol they provide.

If a Singapore company sells to an overseas company, but the ownership of said goods is transferred to a customer of the overseas company in Singapore, then GST will be applied.

When goods are imported, or if there are imported services, into Singapore, they are subject to GST. The total value of import is taxes, including additional fees such as applicable Customs duties and Cost, Insurance, and Freight (CIF), etc.

Here's an example of how to calculate the value of imported goods and the applicable GST:

There are instances where GST may not be applicable.

Certain goods and services are exempted from GST through the Fourth Schedule of the GST Act. These include:

Out-of-scope supply refers to the collection of goods and services outside of Singapore. These are outside the scope of the GST and, therefore, not taxable. However, businesses must retain specific records to prove that these transactions are made overseas.

Zero-rated supply does not equate to exemption. Instead, GST is charged at 0%, hence 'zero-rated'.

Zero-rated GST is applied to:

Like the out-of-scope supply exemption, zero-rated supplies require evidence to prove that the goods being supplied are exported.

All GST registered businesses need to file GST tax returns to the Inland Revenue Authority of Singapore (IRAS).

There are a few critical points to remember for GST returns filing in Singapore:

As mentioned above, businesses will pay IRAS the net GST when they GST returns.

Let us remind you again of the definition of net GST below:

If your input tax is greater, IRAS will refund you. But if your output tax is greater, you're going to pay this tax amount to IRAS.

Let's get an example.

In contrast, there are instances when output tax is greater than input tax.

If IRAS has to issue a tax refund to a business, this refund is made

But before you can receive a GST refund, you have to meet the following conditions:

Here are some things to consider if registering for GST voluntarily suits your Singapore company.

A GST-registered company in Singapore can offset input taxes paid against output taxes they collected (or what we refer to as net GST).

If you think your business will have to pay a lot of input tax compared to the output tax, it might be good to register for GST. This will allow you to get a refund from IRAS.

A GST registered business must adhere to the law's recordkeeping, accounting, and filing protocols. You might need to hire an in-house accountant, or a corporate service provider, to help you with this.

However, because of this GST obligation, your firm will have to spend more money on things like overhead costs.

GST-registered businesses will need to charge GST on their customers’ taxable goods and services. This means your customers will need to pay more on top of the price they're paying.

If your competitors are not registered for GST, your customers might think you are more expensive than them.

Customer perception can also be a factor in deciding whether or not to register for GST.

If your business is not GST-registered and they expect you to be, then they'll end up having a negative perception of your business. They will think you're unreliable, even if your business doesn't need to be registered.

Talk to a corporate service provider or professional accountant to see whether you should get a GST registration for your firm (assuming you don't fall under the mandatory registration category).

The Singapore Government offers different incentives and schemes to help business owners eliminate GST complexity.

Several types of incentives are available to businesses; some are general, while others are industry-specific. For instance:

The Major Exporter Scheme (MES) applies to non-dutiable goods

This scheme is meant to ease businesses' cash flow that import and export goods substantially.

Typically, businesses must pay GST upfront on imports and obtain a refund from IRAS after submitting GST returns.

This often causes cash flow problems for companies that export substantially. This is because no GST is collected from zero-rated supplies to offset the initial cash outflow of imports.

Sellers who purchase goods secondhand don't have to pay GST.

The Gross Margin Scheme lets companies account for the GST on the gross margin instead of the total value of the goods supplied.

Let's say you are a seller of secondhand computers. You bought a computer from a non-GST registered person for $120 and sold the computer to your customer for $350.

What if your gross margin is negative, i.e. selling price < purchase price, and you make a loss?

Well, if that's the case, the gross margin is regarded as zero, and GST won't be charged. However, the selling price must still be reported in the GST return.

Approved businesses can store non-dutiable overseas goods in the Zero GST Warehouse (ZG) without paying GST on said goods.

This GST is only payable when the approved companies import goods from the warehouse for local consumption. Singapore Customs carries out this particular scheme.

This GST scheme is popular amongst tourists as it allows them to claim a refund of the GST paid if these goods are brought out of Singapore. Note that the retailers in Singapore should be GST-registered to enjoy the benefits of this scheme.

The scheme is made available for small businesses whose annual sales do not exceed S$ 1 million. It was developed to help alleviate the cash flow of small businesses whose yearly sales don't exceed $1 million.

Through this scheme, you only account for output tax once you receive customer payment, which eases cash flow. When you claim input tax, you only do so when you pay your suppliers.

This scheme is applicable to business owners who plan on using zero-rate supplies to overseas customers for goods that are hand-carried out of Singapore through Changi International Airport.

The HCES does not apply to goods hand-carried out of Singapore by air (through Seletar Airport), sea, or land.

The Discounted Sale Price Scheme allows business owners to charge 50% GST on secondhand or used vehicles.

Approved GST-registered businesses will only pay GST on imports when their monthly GST returns are due, rather than paying them at the time of importation. This eases import cash flow between payment of import GST and claiming import GST for GST registered business.

As mentioned above, the GST increase has occurred, from 8% to 9% as of January 2024. As business owners, you should consider the following on how it affects your business:

Closing

Knowing about the Singapore Goods and Services Tax (GST) is crucial for business owners, foreign and local, for doing business in Singapore. Knowing about GST rules will not only help you avoid nasty tax penalties, but it will also help you save money in the long run, thanks to the numerous incentive schemes developed by the government.

If you want to know more about GST registration or how it works, you can talk to one of our dedicated accountants here at Piloto Asia. We are one of the best GST registration services in Singapore.

According to the Inland Revenue Authority of Singapore (IRAS), GST-registered businesses are required to charge GST on all sales of goods and services made in Singapore. This includes standard-rated supplies where GST is chargeable at 8%, as well as zero-rated supplies where GST is applied at 0% for the transaction. Additionally, there are specific scenarios where GST may need to be charged or deemed, such as the recovery of expenses, gifts and samples, and the issue of vouchers.

Some businesses are exempted from charging GST in Singapore. This includes businesses that provide most financial services, supply digital payment tokens, engage in the sale and lease of residential properties, and those involved in the importation and local supply of investment precious metals. It is important to note, however, that businesses making only exempt supplies are not eligible to register for GST, and as such, they cannot claim GST incurred on their business purchases.

Your business needs to register for GST in Singapore if its annual taxable turnover exceeds or is expected to exceed SGD 1 million. Additionally, businesses that make only zero-rated supplies (supplies subject to 0% GST) can also voluntarily register for GST to claim input tax credits on their purchases.

It's important to note that the specific accounting entries may vary depending on the nature of the business and the GST transactions involved. For more detailed information, businesses are advised to seek professional advice and refer to the official IRAS guide on GST accounting and compliance.

A GST-registered company in Singapore refers to a business that has either voluntarily registered for GST or has been required to do so due to its taxable turnover exceeding the threshold. A GST-registered company is authorized to charge and collect GST on its taxable supplies. Additionally, it is required to file GST returns and is eligible to claim input tax credits on its business expenses.

It's important to note that the benefits of being a GST-registered company may vary depending on the nature of the business and the GST transactions involved. Businesses are advised to seek professional advice and refer to the IRAS for more information on GST registration and compliance.

Being GST registered in Singapore is important for several reasons. Firstly, it allows your business to comply with the GST laws and regulations, enabling you to charge and collect GST on taxable supplies. Secondly, it enables you to claim input tax credits, which reduces your overall GST liability. Additionally, being GST registered enhances your business's credibility and allows you to engage in transactions with other GST-registered businesses.

The filing period for GST in Singapore depends on the annual turnover of the GST-registered company. For businesses with an annual turnover of less than SGD 5 million, the filing period is quarterly. For businesses with an annual turnover of SGD 5 million or more, the filing period is monthly. Regardless of the filing frequency, the GST return and payment are generally due within one month after the end of the respective filing period.

The penalty for late filing of GST in Singapore can vary depending on the extent of the delay. If the GST return is filed late, a penalty of SGD 200 will be imposed for the first offense and SGD 500 for subsequent offenses. Additionally, late payment of GST may result in a 5% penalty on the outstanding tax amount, along with potential interest charges.

A GST audit in Singapore refers to the process where the Inland Revenue Authority of Singapore (IRAS) examines and verifies a business's GST records to ensure compliance with GST laws and regulations. The audit aims to ensure accurate reporting, proper documentation, and adherence to GST requirements. The audit process may involve reviewing transactions, invoices, and supporting documents, as well as conducting interviews with the business owners or representatives.

During a GST audit in Singapore, IRAS conducts a comprehensive review of a business's GST records.This includes a review of transactions, invoices, and supporting documents. As part of the audit process, IRAS may conduct interviews with business representatives, carry out inspections of business premises, and analyze financial and operational data. The goal is to assess the accuracy and compliance of the GST reporting, identifies any discrepancies, and may issue assessments, penalties, or further investigations if non-compliance is found.

When it comes to exporting goods from Singapore, it is important to know that these transactions are generally zero-rated, meaning they are subject to a GST rate of 0%. However, to qualify for this, the businesses must meet certain conditions. One key requirement is maintaining accurate proper documentation and evidence that substantiate the zero-rating of the supply. Additionally, understanding and complying with the specific GST rules, requirements and customs regulations for exporting goods is essential.

The Goods and Services Tax (GST) Singapore Act is a Singaporean law that provides for the imposition and collection of GST in Singapore and for matters connected therewith. The Act was first enacted in 1993 and has since been amended several times, most recently in 2021. The Act sets out the rules and regulations for the charging, collection, and reporting of GST in Singapore, including the registration requirements for businesses, the calculation of GST, and the filing of GST returns. The Act also outlines the penalties for non-compliance with GST regulations, including late filing or non-filing of GST returns, and the procedures for GST audits and investigations.

Yes. At Piloto Asia, our accounting service can help you with GST registration and compliance in Singapore. Our seasoned team of professionals will guide you through the understanding of GST requirements, ensuring a smooth registration process, and keeping you updated with the latest changes to the GST law. Reach out to us at Piloto Asia, and let's make GST registration and compliance a hassle-free process for your business!

Investment Holding Companies like other businesses, are required to register for Goods and Services Tax (GST) if their annual taxable turnover exceeds SGD 1 million It's also important to note that some businesses may choose to voluntarily register for GST even if they do not meet this threshold. This decision often depends on the nature of the business activities and whether the benefits of claiming input tax credits outweigh the administrative costs of GST compliance

Corporate tax in Singapore is a tax on the profits of companies, while GST is a tax on the consumption of goods and services. Companies registered for GST must collect GST from their customers and remit it to the government. However, companies can claim a deduction for the GST they incur on their purchases.

The filing deadlines in Singapore for GST returns are Monthly returns (Due one month after the accounting period) and Quarterly returns (Due one month after the end of the quarter).

Setting up a holding company in Singapore offers several strategic advantages, particularly when considering GST regulations. One key reason to set up a holding company in Singapore is the favorable tax environment, including the efficient GST framework. Holding companies can benefit from Singapore's clear and business-friendly GST regulations, which may enhance the management of their investments and subsidiaries. Additionally, Singapore's robust legal system and stable economic climate make it an ideal location for holding companies looking to invest in the Asia-Pacific region. The Singapore GST guide for business owners provides further insights into how GST applies to holding companies, helping them to optimize their tax efficiency and compliance.

The Goods and Services Tax (GST) Act in Singapore outlines the tax regulations related to the supply of goods and services in the country, and it also applies to the importation of goods. Singapore introduced GST on April 1, 1994, which is managed by the Inland Revenue Authority of Singapore (IRAS).

Singapore Financial Reporting Standards and GST obligations, while related, serve different purposes. SFRS, established by the Accounting Standards Council (ASC), dictate the accurate recording and presentation of financial transactions in your financial statements. These standards ensure that your financial reports reliably reflect your business's financial performance and position. GST, or Goods and Services Tax, is a consumption tax applied to the supply of goods and services in Singapore and the import of goods. Your GST obligations are determined by tax legislation, focusing on the nature of your transactions and whether they are subject to GST. While SFRS itself does not directly affect your GST liabilities, the financial statements prepared under SFRS provide essential information for GST reporting. For instance, revenue recognized in your financial statements under SFRS may help determine your taxable supplies for GST purposes. Therefore, accurate financial reporting according to SFRS is crucial for fulfilling your GST obligations correctly. Piloto Asia, as your dedicated corporate service provider, is here to assist you in navigating both the complexities of SFRS compliance and managing your GST reporting obligations. Our expertise ensures that your business remains compliant with Singapore's financial and tax regulations, safeguarding against potential discrepancies and penalties.

Navigating the Goods and Services Tax (GST) landscape in Singapore can be challenging for businesses. Piloto Asia's outsourced accounting services in Singapore are specifically designed to ease this burden. Our team of professional accountants brings deep expertise in Singapore's GST framework, ensuring your financial transactions are meticulously organized for compliance. We can organize your financial transactions, provide accurate and timely GST filing, and offer strategic advice to optimize your tax position. By choosing our outsourced service, you not only achieve compliance with confidence but also free up essential resources to concentrate on your core business activities. Ensuring GST compliance is crucial for the success and smooth operation of your business in Singapore, and we're here to help you achieve just that.

At Piloto Asia, we recognize the complexities of navigating Singapore's tax environment for businesses. Understanding the interaction between Singapore company tax and GST registration is crucial for compliance and optimal tax planning. Corporate tax in Singapore is levied at a flat rate of 17% on the chargeable income of companies, focusing on the profits earned. On the other hand, GST is a consumption tax applied at 7% on the supply of goods and services, affecting the pricing and sales processes of businesses. While corporate tax and GST are calculated and managed separately, they are interconnected in the broader scope of a company's financial and tax planning strategies. For instance, GST-registered businesses must account for GST on their taxable supplies, which can impact their cash flow and operational costs, indirectly influencing their taxable profits and, consequently, their corporate tax obligations. Our detailed guides on corporate tax and GST in Singapore provide essential insights for businesses to navigate these obligations effectively, ensuring compliance and leveraging available tax benefits to optimize their overall tax position.

As Singapore's #1 corporate service provider, Piloto Asia prides itself on its ability to provide a comprehensive range of business services, including affordable company formation services. We cater to both local and foreign business owners, guiding you through every step of the process to ensure that setting up your business is smooth and hassle-free. Our transparent pricing ensures you receive high-quality service without any hidden costs, making business formation both accessible and efficient.